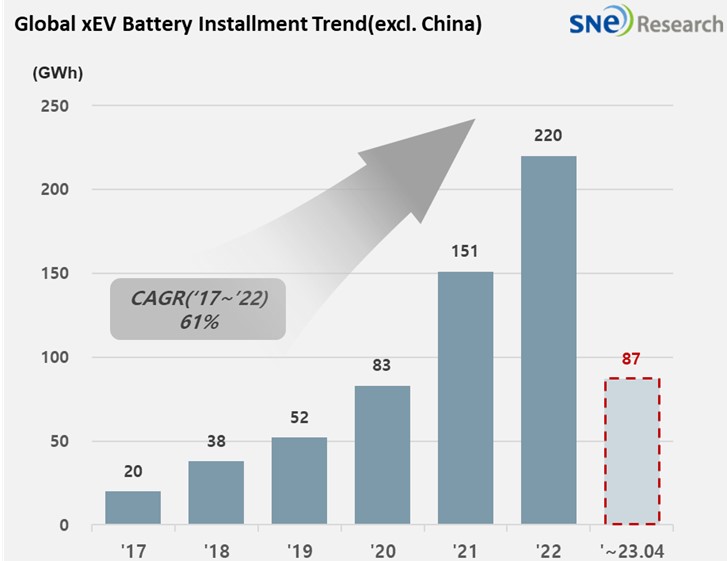

From Jan to Apr 2023, Non-Chinese Global[1] EV Battery Usage[2] Posted 86.7GWh, a 49.4% YoY Growth

- K-trio recorded 47.4% M/S combined, with LGES keeping No. 1 Position

Battery

installation for global electric vehicles (EV, PHEV, HEV) excluding the Chinese

market sold from January to April 2023 was approximately 86.7GWh,

a 49.4% YoY growth.

(Source: Global EV and Battery Monthly Tracker – May 2023, SNE Research)

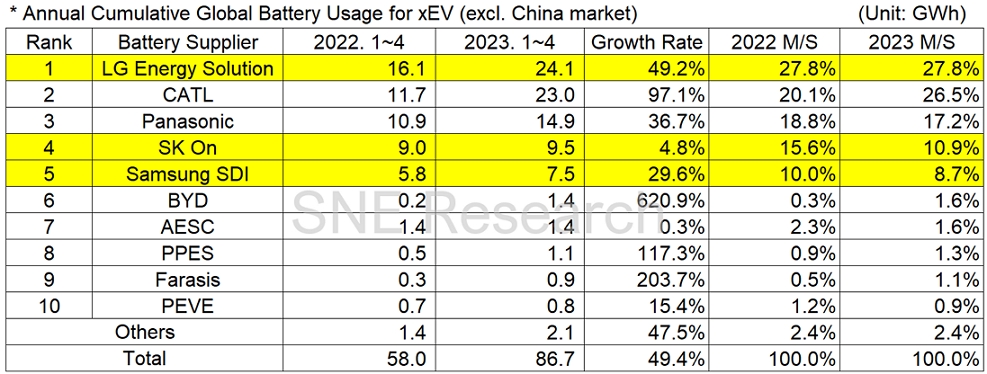

In the ranking of battery usage for electric vehicles, the K-trio battery makers all entered the top 5 in the ranking. LG Energy Solution maintained the leading position with a 49.2% YoY growth (24.1GWh), while SK On ranked 4th with a 4.8% YoY growth (9.5GWh) and Samsung SDI ranked 5th with a 29.6% YoY growth (7.5GWh). CATL took the 2nd place on the list, registering a double-digit growth rate of 97.1%(23.0GWh).

(Source: Global EV and Battery Monthly Tracker – May 2023, SNE Research)

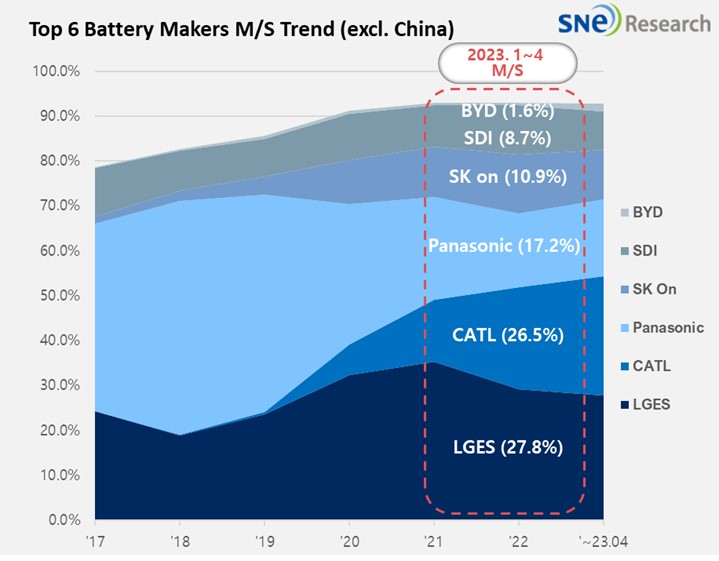

Although the combined market

share of the K-trio recorded 47.4%, a 6.0%p decline from the same period of

last year, the total usage of their battery was found to be in an upward trend.

Their growth was mainly affected by strong sales of electric vehicle models

equipped with batteries of each company. LGES continued to expand based on the

increasing sale of Tesla Model /Y, VW ID. 3/4, and Ford Mustang Mach-E. SK On’s

growth trend was led by the popularity of Hyundai IONIQ 5/6 and KIA EV6 in the

global market. Samsung SDI was also in an upward trend thanks to the sale of BMW i4/7/X, Rivian’s pick-up

truck R1T/S, and Audi E-Tron.

Panasonic posted 14.9GWh of

battery usage this year, experiencing a 36.7% YoY growth. As one of the major

battery suppliers to Tesla, Panasonic saw such double-digit growth thanks to

the strong sale of Tesla Model S/X/3/Y and Mazda CX-60 PHEV.

Together with CATL, some of the Chinese companies have also shown a high growth even in the non-China market, gradually expanding their presence on the global stage. CATL ranked 2nd in the non-China market thanks to strong sales of Tesla Model 3 (made in China and exported to Europe, North America, and Asia), Volvo C40/XC40 Recharge, Peugeot e-208/2008, and MG ZS. As it has been known that CATL’s battery may be installed to a new KONA model made by Hyundai, it is expected that CATL’s share in the non-China market would further expand. BYD, exhibiting the highest growth among the top 10 companies, has drawn a high popularity in the Chinese domestic market based on its price competitiveness earned through vertical integration of SCM such as in-house battery supply and vehicle manufacturing. Taking advantage of its price competitiveness, targeting the Chinese domestic market, and product quality, BYD is expected to see a rapid increase in its share in the markets of Europe and Asia. Farasis also continued a steady growth in 2023 owing to the favorable sale of Mercedes EQ line-up, exported to Europe, which is regarded as one of the best-selling car models in the world. very popular among the global customers.

(Source: Global EV and Battery Monthly Tracker – May 2023, SNE Research)

Following 2022, LG Energy Solution maintained No. 1 position in the non-China market in 2023, but CATL has been coming after LGES to capture the top position based on its high growth. As the growth rate of Chinese domestic market – the world’s biggest EV market – has slowed down and competitions among the Chinese companies have become fiercer, those Chinese makers are expected to make inroads into the oversea market. Given the fact that OEMs have started to implement a so-called price differentiation strategy after Tesla launched a low-price competition, the Chinese makers seem to take LFP battery as their key strategic tool to target the overseas market. Specifically in Europe where the usage of LFP battery is low, there may be a change in the market shares of Chinese makers.

[2] Based on battery installation for xEV registered during the relevant period.